Preparing for the Unexpected

4 industry experts who've spent their careers shaping practices of enduring and transferrable value will share:

✔ Importance of Continuity Planning

✔ Elements of an effective Continuity Plan

✔ How Continuity Planning can stimulate growth

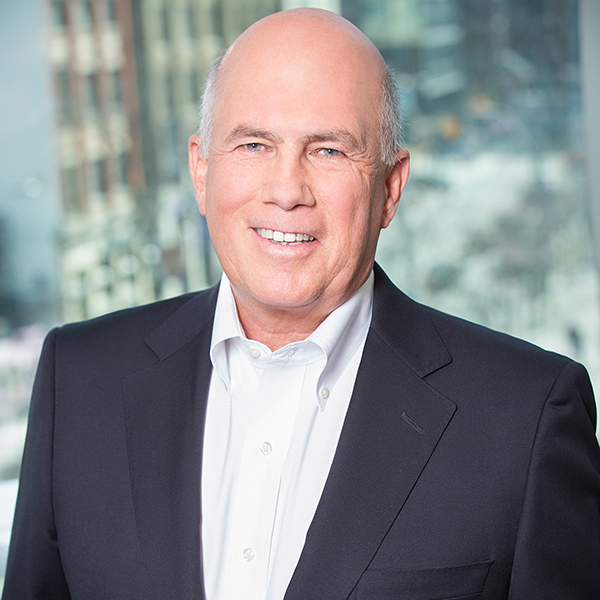

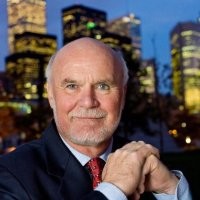

- David Gray, George Hartman, Bob Labrecque, Kim Siegers-Robinson

- 1PM EDT